SELF-INSURED MEDICAL EXPENSE REIMBURSEMENT PLAN (SIMERP)

A SIMERP is an employer-sponsored program in the workplace. It is a preventive care management program funded by a SEC.125 premium deduction. Therefore, it is IRS, HIPAA, and ERISA compliant- AVAILABLE AT NO NET COST!

Other Insurances

Employer Features

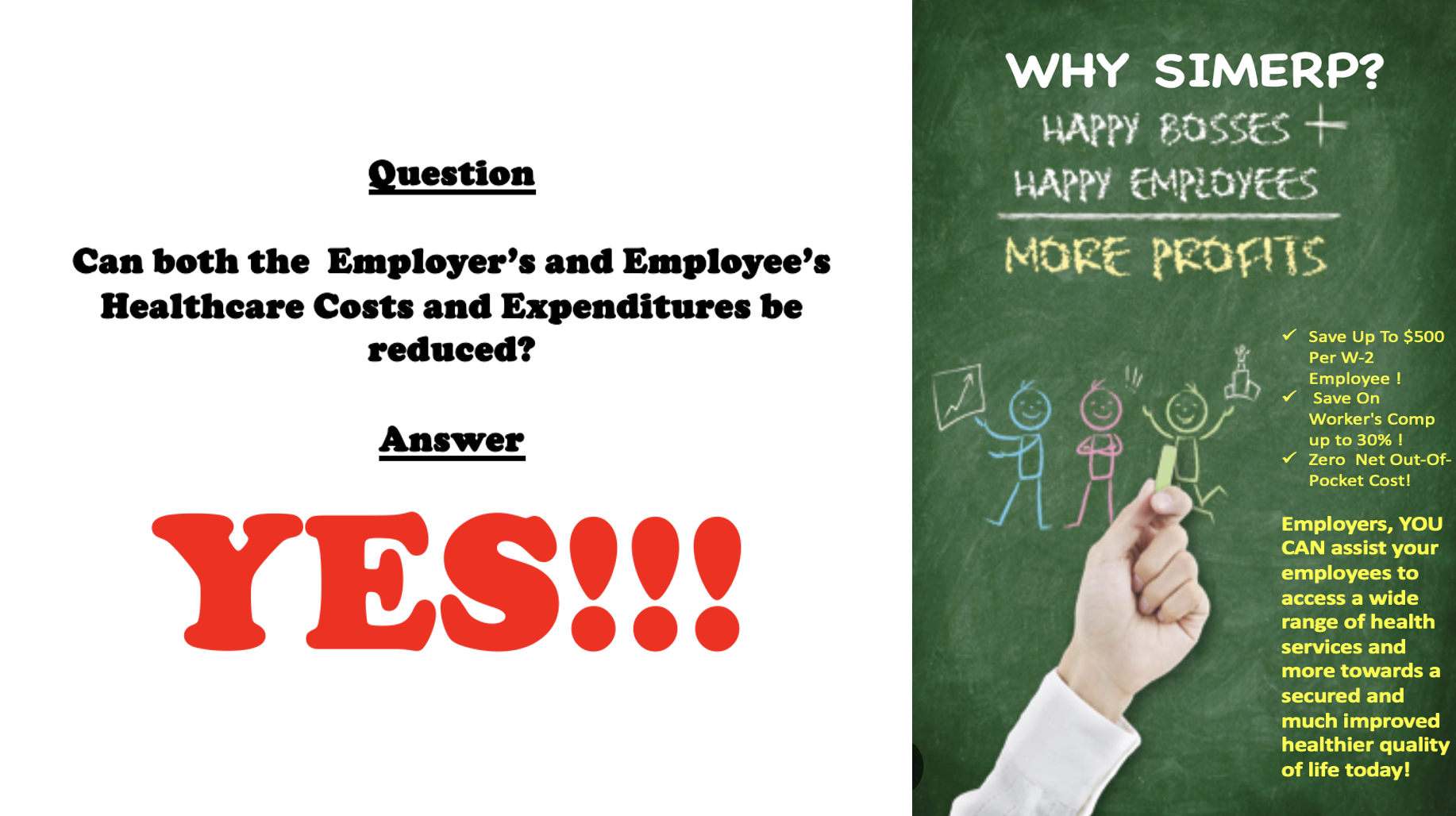

- Employers can save up to $500/ year in FICA net savings per participant.

- Reduce workers’ comp by up to 30%.

- Lower work comp claims significantly.

Employee Features

- SIMERP can reduce taxable income of up to $900 per month with all pre-tax deductions remaining unaffected.

- Participating employees choose guaranteed issue accident, disability, critical illness with cancer or whole life insurance to supplement healthcare cost through COMBINED INSURANCE.

- All services DO NOT AFFECT TAKE-HOME PAY..

HR Features

- Can be seamlessly integrated with all Payroll System.

- Minimal effort for your company’s payroll staff.

- Provides companies assist with dedicated Client Service Personnel

Up to how much can taxable income reduce per month with all pre-tax deductions remaining unaffected?

%

Let Us Help to See if You Qualify!

Frequently Asked Questions

Employer FAQ

As an employer, how many employees on W2 should I have to be eligible to implement a SIMERP Program?

Employers must have a minimum of 15 employers or more to be able to implement a SIMERP Program.

Is there a cost to implement this program for my company?

There will be $46 per employee fee to implement this program.

How does my company benefit from this program and not just have an additional expense?

Employers benefit from this program in multiple ways:

- Company’s workers’ comp gets reduced by 30% while keeping the program in place.

- Monday morning work claims historically gets reduced.

- Employers gain an average of $400- $500 savings in FICA taxes annually.

Employee FAQ

As an employee, how do I qualify for this program?

As an employee, you must be on W2 with a major medical/ health insurance through an employer-sponsored plan, either of your own, from your spouse or if you are below the age of 26 years old, through the insurance of your parents.

Is there a cost to me as an employee to join this program if its offered by my employer?

As an employee, there is a cost for every service from every provider that actually comes out from the tax savings the program incurs for you. Therefore, you get to access the participatory preventive care management program and still have funds to purchase supplemental coverages such as accident, disability, critical illness and cancer and whole life policies while having the same take-home pay.